Miami Collision Repair

Sofia Collision was established in 1971 on $ 500 and a dream. The brothers, Steve and Tony Sofia along with their father, Anthony Sr., decided to open the business because they believe a family owned operation has more quality than a dealership. Years of hard work, dedication to the customer and quality repairs propelled the body shop to become the biggest and most reputable collision center in Rochester area. So much so, that Sofia has become a household name and Auto body shop miami

Initially located at 131 Garson Avenue, Sofia Collision moved to one of its present locations, at Palmer Street, in 1986. The business grew by leaps and bounds, and in February 2002, Anthony and Steve were able to open a new location on Lyell Avenue in Gates.

Sofia Collision strictly uses DuPont paint products. In May 2001, shop joined the elite group of shops countrywide to be featured in the DuPont Trade Magazine. Sofia Collision belongs to the DuPont Quality Assurance Program, and was the first facility to join the program in New York State.

Sofia Collision is proud to be a member of the Better Business Bureau.

Sofia Collision is a direct repair shop for Allstate Insurance, Amica Insurance, Consolidated Services, Erie Insurance, Hanover Insurance, Hartford Insurance, Metropolitan Insurance, New York Central, Onebeacon Insurance, PH&H, State Farm Insurance, and Travelers Insurance.

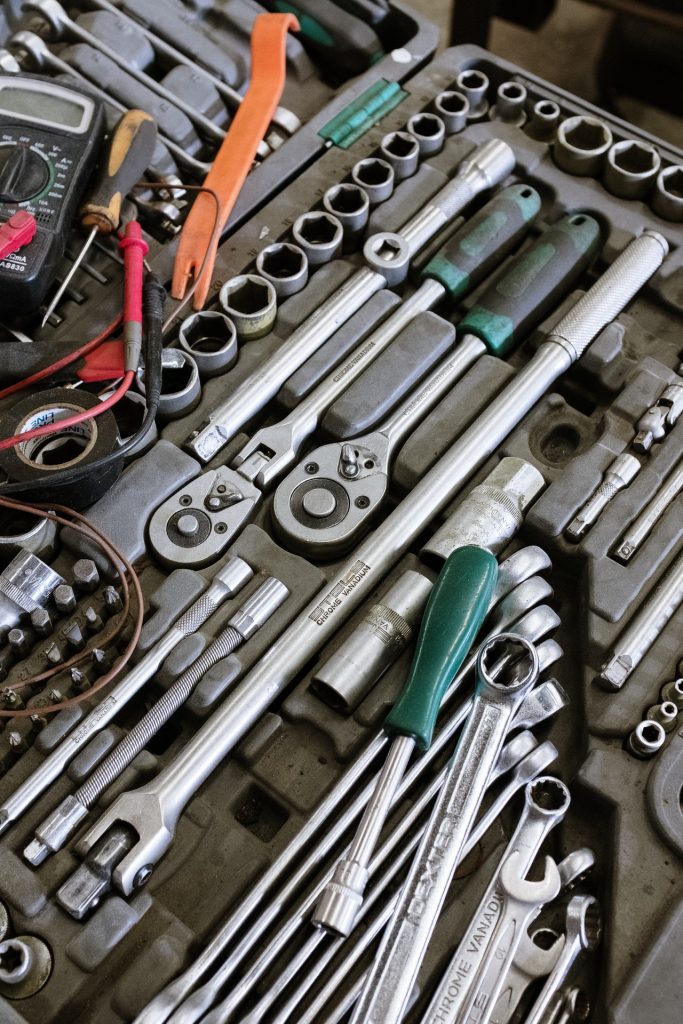

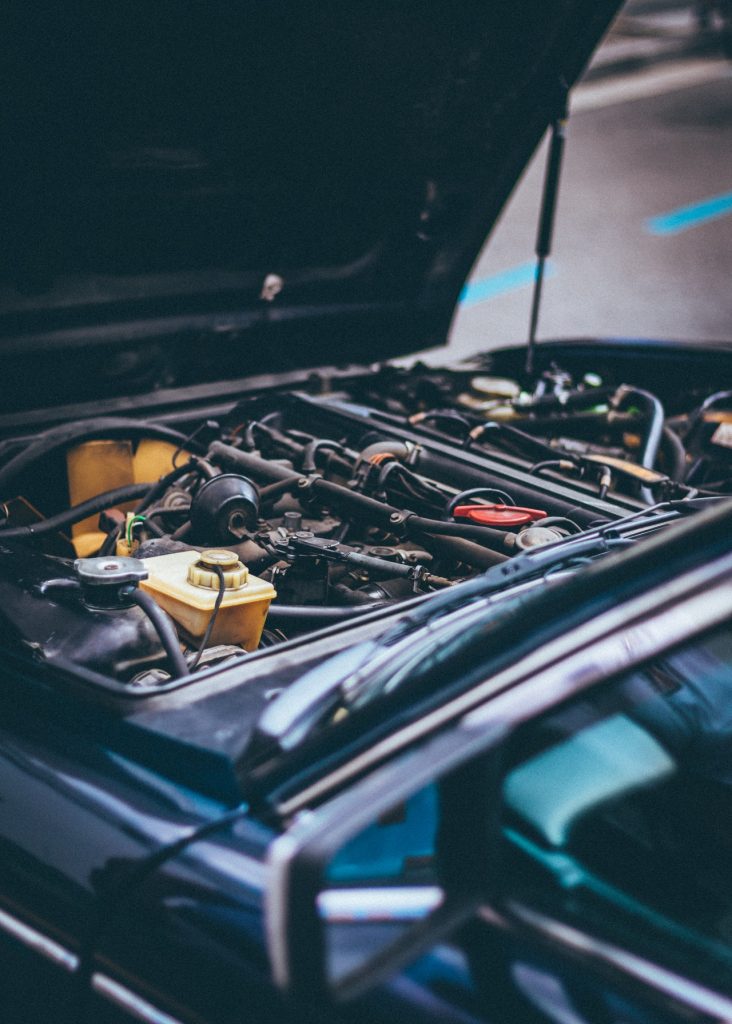

Sofia Collision offers a complete array of services to bring your car to pre-accident condition. We have 2 state of the art facilities filled with the latest tools, diagnostic equipment, frame machines and top of the line spray booths to ensure quality repairs. Our technicians are ASE and I-CAR certified. Sofia Collision is DuPont Quality Assurance shop – one of only few in florida and wheel alignment services Miami

- Guaranteed Repairs

- ASE and I-CAR Certified technicians

- Kansas Jack Frame Correction Equipment

- Shark Measuring System

- Nova Verta Paint & Cure Booth

- Computerized Four Wheel Alignment System

- Air Conditioning Service

- State of Art DuPont Paint Matching System

- High Quality Paint Products (DuPont)

- Glass Replacement and repair

- Undercoating

- Paint and Decal Striping

- Excellent Selection of Rental Vehicles

- 24 – 7 Towing Services

No matter what kind of repair needs to be performed, you can rest assured that Sofia Collision has the technology and the people to bring your car back to its pre-accident condition. If there is a question that you have, please contact us.

Know Your Rights

In New York you have the absolute right to select the collision repair shop of your choice. No insurance company, independent agent, representative, appraiser, adjuster or staff member of an insurance company can legally force you to or away from any specific repair shop, require that repairs be made by a specific repair shop or individual. Nor can they require you to have your vehicle inspected at their drive-in claims center. If you request it, your insurer must inspect the damage to your vehicle at your chosen location or collision repair shop. (Regulation 64)

- You have the right to have your vehicle towed to any location that you choose.

- You must notify your insurance company before repairs begin.

- You do not have to go to a drive-in claims center. Your insurer must inspect the vehicle at any location you choose, within 6 working days.

- You do not need to get two or three appraisals.

- Your insurance company is responsible for payment to restore your vehicle to pre-accident condition.

- Your insurer must negotiate in good faith with the shop of your choice.

- The registered repair shop you choose should provide an estimate of damage and assist you with the processing of your claim to ensure safe and proper repairs are made to your vehicle.

- A repair shop has no right to speak on your behalf without first given Designated Representative Authority by you.

Sofia Collision wants to ensure your rights are protected. If you have any questions, be sure to contact us.

Sofia Collision is Rochester Area’s largest and best collision repair facility. With locations in Rochester and Gates, we have everything needed to provide customer with quality repair and award winning customer service.